TurboTax Home & Business free version download for PC

Table of Content

You can prepare the return yourself using the instructions and paper forms. We only sell authentic and original products and we offer money-back guarantee for any product we sell. Boost your bottom line with industry-specific tax deductions and credits.

Expecting a 1099-K for the first time? Guides you through deducting points, appraisal fees, and more from your refinance. This is a new, never used, fully registrable 2015 TurboTax Home & Business Federal + State + 5 Federal Personal Efiles and ItsDeductible software package. You will find everything needed for your corporation or partnership taxes.

Intuit Turbotax 2015 Download

Does not include calculation errors due to errors in CRA tables. Windows 8.1 and macOS Catalina 10.15 not supported, click here for full system requirements. Select all that apply to find reviewers similar to you.

You'll get on-demand advice from a TurboTax Expert along with a full review of your tax return. Get live help from tax experts, plus a final review before you file — all free. The primary differentiator between Home and Business and Business is based upon entity type. Those who file with TurboTax Business will still need to file their personal taxes. If you prefer the standard CRA forms, you can seamlessly switch over for a more traditional and familiar tax preparation experience.

Download Tax Software - 2017

Guides you through common life changes, big or small, and finds any new tax deductions and credits you may qualify for. Free U.S.-based product support by phone and easy-to-understand answers online 24/7. @brandnew831"would have owed a refund" makes no sense at all. When you prepare a tax return you either OWE tax due or you can RECEIVE a refund.

See Terms of Service for details. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Claims must be submitted within sixty days of your TurboTax filing date, no later than May 31, 2023 (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2023). Audit Defence and fee-based support services are excluded.

Member reviews & questions

There is no such thing as owing a refund. To clarify, they withheld the amount I owed for 2015 from my 2020 refund, so now don't owe for 2015 anymore. You can try filing the 2015 return. You will not be able to use TT software---that software is no longer available.

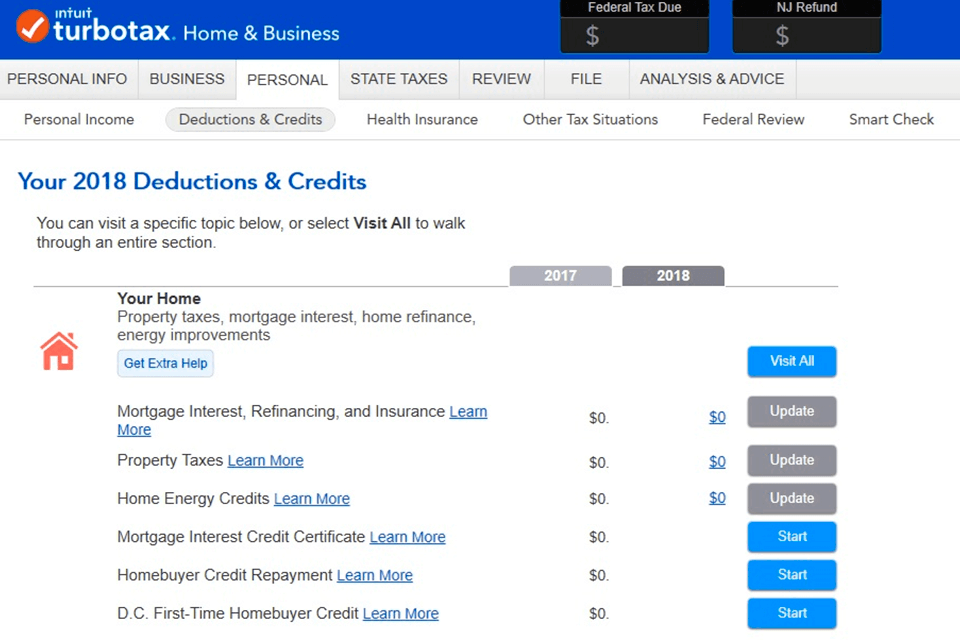

Understand your tax history and know your “tax health” with suggestions to help you get an even bigger refund next year. Displays your refund in real time, so you always know where you stand. Your biggest investment might also be your biggest tax break—mortgage interest, property taxes, and more.

For Basic, Standard, Premier, Home & Business, Deluxe Online, Premier Online, and Self-Employed Online, technical support by phone is free. Intuit reserves the right to limit each telephone contact. Support availability subject to occasional downtime for systems and server maintenance, company events, observed Canadian holidays and events beyond our control.

If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. Free filing is only available in certain products. If not 100% satisfied, return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price. This guarantee does not apply to TurboTax Free.

E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. TurboTax Online prices are determined at the time of print or electronic filing. All prices are subject to change without notice. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible.

Claims are based on aggregated sales data for all NETFILE tax year 2021 TurboTax products. Internet connection and acceptance of product update is required to access Audit Defence. Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Includes field audits through the restricted examination of books, but does not include the "detailed financial audit". TurboTax runs through thousands of error checks and double-checks your tax returns before you file so you can be confident nothing gets missed. Searches for more than 350 tax deductions and credits to get you the biggest tax refund—guaranteed.

Perfect for multiple sources of income, including sales from goods and services. TurboTax can help find you any new tax deductions and credits. If you sold stock, easily determine your correct basis for shares purchased--even at different times or different prices. Upload a picture or PDF of your W-2 or 1099-NEC to import your data securely into the right forms. Perfect for multiple sources of income, including independent contractors, freelance workers (1099-MISCs & NECs) and sales from goods and services.

Create unlimited W-2,1099-MISC, 1099-INT and 1099-DIV forms. Before you file, thousands of checks are run to help identify missing deductions or credits. Save turbotax home business 2015 to get e-mail alerts and updates on your eBay Feed. We'll ask you questions specific to your industry and find deductions personalized to your line of work, helping you uncover tax breaks you otherwise may have missed. Testimonials are based on TurboTax Online reviews from tax year 2021 as well as previous tax years. Shipping Shipping Terms Buyer pays for shipping expensesSeller ships to United States address only.

TurboTax Home & Business is for people whose business income needs to be reported on their personal tax return. If your business is incorporated, you need to prepare a personal return for yourself and a separate corporate return for your business. TurboTax Home & Business is a great fit for your personal return and for your corporate return, check out incorporated business edition, TurboTax Business Incorporated. TurboTax calculations are 100% accurate on your tax return, or TurboTax will pay any IRS penalties. Once you complete your federal taxes, transfer your information over to your state return . More than 5 million Canadians use our software to get their maximum tax refund, every single year.

This guarantee cannot be combined with the TurboTax Satisfaction Guarantee. TurboTax Home & Business is the complete program for filing both your personal and small business taxes. It combines the power of TurboTax Premier America's #1 tax preparation software with special features and advice for sole proprietors. The CRA typically estimates 8-14 days for electronic transmissions with direct deposit. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Comments

Post a Comment